What you need to know

The 401(k) plan is a great way to build a nest egg for retirement. Workday pitches in to help you reach your long-term savings goals. Plus, you have two contribution options, so you can decide whether you want to pay taxes now or later. Through it all, Northstar Financial Planners, Inc. can offer guidance on the best 401(k) contribution and investment options for your situation.

Rely on your Benefits Buddy

Have you met Purav? When you or a family member has questions, he has answers. Purav can work with you on retirement planning, 401(k), and HSA benefit advice. Visit the events page to schedule a 1:1 appointment. Fidelity 1:1s are generally available on the third Wednesday of each month.

Highlights

- Save up to 75% of your gross wages (including salary, time off, bonuses, and commission) up to $24,500 in 2026, with traditional pretax and Roth contributions. If you're age 50+ in 2026, you can save up to $32,500. Bonus, if you’re age 60-63 in 2026, you can save up to $35,750.

- Designate a different contribution amount for variable pay like bonus or commission payments.

- Change your contribution amount anytime throughout the year.

- Get a 50% company match on the first 6% of your pay you contribute as pretax and/or Roth contributions. That’s free money every pay period. Note: To qualify for the company match, interns must wait until they’re a permanent Workmate.

- Put away even more with after-tax contributions. The total of all your contributions, including the company match, can be up to $72,000 in 2026. Reminder super savers: Workday manages the IRS annual after-tax contributions maximum on your behalf.

- New to Workday? Welcome! If you contributed to a 401(k) at your previous employer, please fill out this questionnaire. We’ll make sure you don’t exceed the IRS annual maximum for pretax and Roth 401(k) contributions—but only if you complete the questionnaire.

- All contributions, including the company match, are always 100% yours.

How matching contributions work

Contribution example

Contribution example

This example shows how much Workday contributes to your 401(k) based on an annual base salary of $100,000.

| If you contribute this percentage of your pay to your 401(k)… | You’ll be contributing this much in a year… | And Workday will add this much more |

|---|---|---|

| 3% | $3,000 | $1,500 |

| 5% | $5,000 | $2,500 |

| 6% | $6,000 | $3,000 |

| 7% | $7,000 | $3,000 |

| 10% | $10,000 | $3,000 |

Workday will match half of your contribution up to 6% of your pay (equal to 3% of your eligible earnings). You can contribute more than that if you’d like. But, if you contribute less than 6%, you won’t receive the maximum Workday match.

If you join Workday midyear, Workday’s potential match is based on 6% of your actual eligible earnings for that year, not your potential annual salary.

When you’ll meet your match

When you’ll meet your match

There’s one more thing you should know: Workday’s match is capped at 50% of the first 6% of your pay you contribute each pay period. That means if you contribute more than 6% of your pay, it will take until the end of the year for Workday to catch up, through a process called a “true-up.”

Here’s an example. Let’s say you make $135,000 per year, and you contribute 25% of your pay to your 401(k) as pretax contributions.

- Workday’s match for the full year will be half of the first 6% of your pay, or $4,050.

- Each pay period, you’ll contribute $1,250, which is 25% of your biweekly earnings. Workday will match half of the first 6% of your earnings, or $150.

- You’ll hit the IRS contribution limit of $24,500 in the 20th pay period (i.e., in September). But Workday’s contributions so far will only have reached $3,000, which is short of the $4,050 full-year match.

- For the remaining seven pay periods, Workday will make true-up contributions to your 401(k) until you’ve received the full-year match of $4,050.

The IRS limit for eligible pay is $360,000 in 2026, so your maximum Workday match for the year is $10,800 in 2026 if you make more than that.

Save for later while paying off student debt

When you enroll in the Student Debt 401(k) Match Program, you can use your student loan repayments to qualify for the Workday 401(k) matching contribution. So, as long as you’re setting aside 6% of your pay between your 401(k) contributions and your student loans, you won’t miss out on any free money.

401(k) contributions and taxes

There are different types of 401(k) contributions, and each has different tax implications. Generally, if you expect your income tax rate to be lower in retirement than while you’re working, then pretax contributions may make sense, since you will be taxed when you take a withdrawal. If you expect to have a higher income tax rate in retirement, then Roth contributions might make more sense for you. You can also boost retirement savings with additional after-tax contributions.

The financial planning experts at Northstar can help you figure out which contribution strategy is ideal for you.

Traditional pretax

Traditional pretax

Your contributions are taken on a pretax basis. That means lower federal and state taxes now, but you’ll pay taxes when you get your money in retirement. You earn the Workday match on pretax contributions.

Roth

Roth

You pay taxes on your contributions now, but no taxes on contributions or investment earnings when you get your money in retirement. You earn the Workday match on Roth contributions.

After-tax

After-tax

You pay taxes on your contributions now, and any investment earnings will be taxed when you take a withdrawal. There is no Workday match for after-tax contributions.

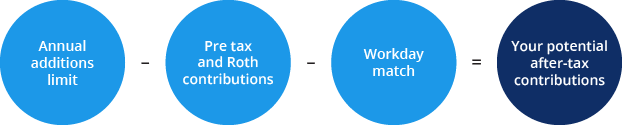

After-tax contributions can be a viable investment strategy in the right circumstances. After-tax contributions let you save beyond the IRS limits on pretax and Roth contributions, which helps you if you have extra money to put toward retirement. In most cases, for 2026, this means you can contribute up to $72,000 of your eligible compensation (your combined pretax, Roth 401(k), and employer contributions). Use this formula to determine how much you can contribute after-tax:

After-tax contributions grow tax-deferred, but you pay taxes on investment earnings when you make withdrawals. You can continue to enjoy tax benefits by converting after-tax contributions to Roth.

You can convert your after-tax money to Roth at any time, and there is no limit to how often you can convert. You can make converting easier by signing up for automated conversions with Fidelity.

Save smart

Many factors can affect your decision on how to contribute to a 401(k). Your best bet is to talk to a Northstar Financial Planner.

New to Workday?

Enroll in the 401(k) on the Fidelity website starting 10 days after your hire date. If you contributed to a 401(k) with your previous employer, make sure to avoid exceeding your annual contribution limit by completing the 401(k) questionnaire through Workday. Instructions can be found on Horizon.

To explore more about the 401(k) on your own, read Fidelity’s Guide to Getting Started.

Feeling financially lost?

If you need help with financial planning, we have two options for you.

You can seek advice from a Northstar Certified Financial Planner®. All you need to do is sign up and get in touch at a time that is convenient for you. Or, you can work with a financial expert from Fidelity. Fidelity sessions are generally scheduled every two weeks. Check the event calendar for details and to sign up.